Starmer says talks over US economic deal are ‘well advanced’

Sir Keir Starmer has said that talks with the US on a trade deal which would help Britain avoid being hit by Donald Trump’s import tariffs are “well advanced”.

“We are discussing economic deals,” Sir Keir told Sky News. “These would normally take months or years, and in a matter of weeks, we’ve got well advanced in those discussions.”

Andy Gregory1 April 2025 11:26

Some US tech firms see share prices rise in pre-trading

Looking ahead to the US market opening in a few hours, while most of the major names sunk yesterday in early trading, there was a significant rebound later in the day.

The S&P 500 closed about 0.5 per cent higher in the end, and several tech names are seeing share price rises in pre-trading.

There’s still time to change here, but Tesla is poised to open 3.5 per cent up, Nvidia 1.1 per cent up, Alphabet 0.7 per cent up, Microsoft and Amazon are flat.

Opportunistic buying at lower prices, or is optimism over a lower tariff impact slowly coming back?

Karl Matchett, Business and Money Editor1 April 2025 11:13

Food standards a ‘red line’ in US economic talks but tech firms tax on the table, suggests UK minister

“Sensitive areas” such as food standards will be a “red line” in UK economic talks with the US, but axing plans for a digital services tax on US tech firms could be on the table, the business secretary has suggested.

Speaking to Times Radio, after the newspaper reported that UK minsters have already conceded that they will drop plans for a digital services tax in their talks with US counterparts, Jonathan Reynolds said: “There are sensitive areas you can’t go to.

“Other countries understand that the regime that we put in place in the UK, what we call our SPS [Sanitary and Phytosanitary] regime, which is our food standards regime, that’s a red line for us. That’s a really important area that we wouldn’t be able to negotiate on and the US understands that position as do other countries.”

While a “digital services tax” – whereby global tech firms “pay a rate of tax in the UK that is commensurate to their economic activity” in Britain – is “an important principle”, Mr Reyndods said, he added: “But how we achieve that – we’ve always wanted to reach that on an international basis.

“Digital services tax in itself was a temporary imposition in lieu of a wider international agreement. So how we deliver upon that is something we can talk to any country in the world.”

The Times reported on Monday night that UK ministers were particularly frustrated to learn that Britain would be hit by US tariffs this week because they believed an economic deal – including concessions on a digital services tax and agriculture, but none on food hygiene standards – was ready to go.

Andy Gregory1 April 2025 11:06

Where are investors going if they’ve been selling up?

It’s not just the FTSE which was down yesterday; the S&P 500 is down more than 5 per cent in the last month and the Nasdaq sits on -8.2 per cent across the same time frame.

All that selling doesn’t mean money just sits in bank accounts though; traders and investors typically want to trade or invest, not maintain full liquid – or cash – positions.

So, they look for alternative assets. Crude oil is up about 2.5 per cent for the past month, but the real winner has been gold. The price of gold futures – which tracks the price of perceived safe-haven bullion – has risen to above $3,150, with new all-time highs being set every day at the moment.

Gold is up more than 21 per cent since the start of 2025. Analysts foresee a continuation along that path to around $3,300 by the end of the year.

Karl Matchett, Business and Money Editor1 April 2025 10:44

Goldman Sachs downgrades UK growth forecasts as Trump tariffs loom

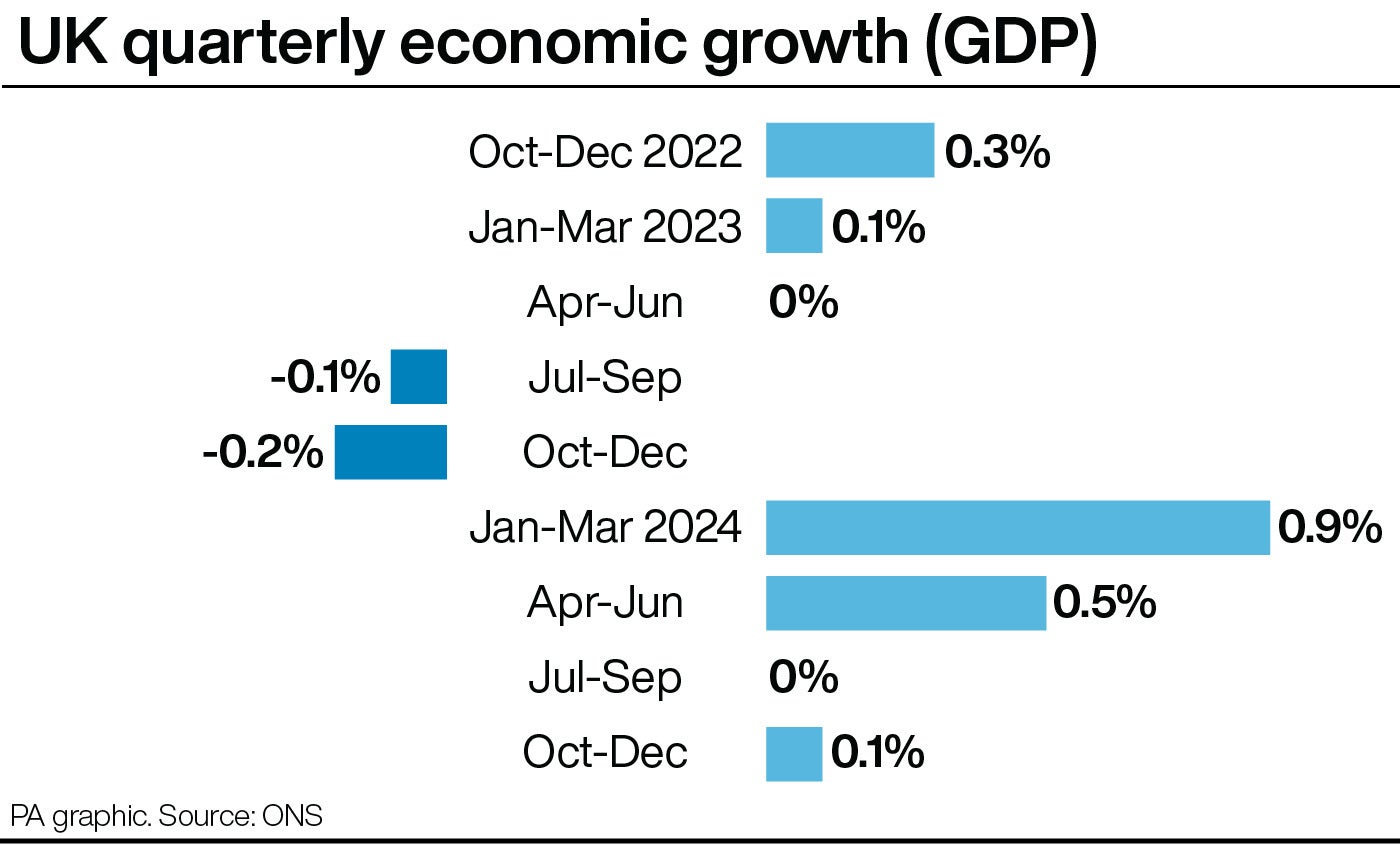

Goldman Sachs economists have downgraded their expectations of UK growth as Britain braces to be hit by Donald Trump’s trade tariffs.

Even if ministers secure the economic agreement they are seeking with the US, Goldman Sachs analysts said they still expect the UK’s GDP to suffer a greater hit than previously anticipated due to “larger negative spillovers” from trade tariffs levied against the European Union.

As a result, the bank now expects 0.8 per cent of UK growth this year and 1.2 per cent in 2026 – down from 0.9 and 1.3 respectively.

The bank’s chief European economist Sven Jari Stehn was quoted as saying by The Telegraph: “Even if the direct hit to GDP from lower exports to the US is modest, the overall drag on UK growth from trade fragmentation is likely to be greater.

“The larger US tariffs on other economies included in our new baseline imply a larger growth hit in the US and the Euro area, which should result in larger negative spillovers to the UK.”

The below chart tracks UK quarterly growth since late 2022, according to the Office for National Statistics:

Andy Gregory1 April 2025 10:13

EU has ‘strong plan’ to retaliate against Trump tariffs if necessary, says von der Leyen

The European Union will be ready to retaliate against US trade tariffs with strong countermeasures if needed, European Commission President Ursula von der Leyen said on Tuesday.

“Our objective is a negotiated solution. But of course, if need be, we will protect our interests, our people, and our companies,” Ms von der Leyen said in a speech in the European Parliament in Strasbourg.

“We do not necessarily want to retaliate. But if it is necessary, we have a strong plan to retaliate and we will use it.”

Andy Gregory1 April 2025 09:59

Rise in employer NI having ‘massive impact’ on young people, says Kemi Badenoch

The impending rise in employers’ national insurance is having a “massive impact” on young people seeking work, Kemi Badenoch has said.

Supermarkets have been “shedding jobs” and hairdressers cannot afford to take on new staff, the Conservative Party leader said ahead of employer national insurance contributions rising on 6 April.

She told LBC: “The rise in the threshold for where you pay national insurance has meant that lots of people who didn’t cost as much to hire now do – that’s having a massive impact on young people.

“People who take on apprentices have stopped. So hair salons, for instance, have been one of the businesses that have screamed the most that they’re just not able to afford to take on new staff.

“And it’s affecting sectors like that, hospitality, anyone who takes on young people is going to be severely impacted. But the truth is, everybody’s impacted. The supermarkets have been shedding jobs.

“Lots of people are saying that if they’re going to afford such a high wage bill, they either have to pay level wages, stop hiring, and in some extreme cases, just stopped business altogether.”

Andy Gregory1 April 2025 09:53

Trump tariffs offer UK a potential fortune through trade diversions, expert suggests

Research from Aston Business School places the economic impact of tariffs at $1.4trn – if it escalates into a full-scale trade war.

Business secretary Jonathan Reynolds may feel the UK is uniquely placed to strike the best deal out of any nation but that doesn’t mean it will escape entirely unscathed.

Professor Jun Du, of the Aston Business School, said: “The picture for tariff measures may not be clear at the moment, but what is clear is that economies like the UK need to plan for various eventualities and start to put mitigating measures in place.

“US tariffs offer the UK a potential fortune through trade diversions, yet these gains could complicate efforts to reset UK–EU relations, amplifying economic divergence, political distrust and misalignment.”

Karl Matchett, Business and Money Editor1 April 2025 09:49

How UK hopes of tariffs exemption collapsed as Trump pushes for ‘big bang’

Hopes that the UK could avoid Donald Trump’s tariffs reportedly collapsed last Thursday during a meeting in which US negotiators made clear there would be no exemption.

According to The Times, US negotiators made clear that Mr Trump wants to make a “big bang” with his expected announcement of tariffs on all of Washington’s trade partners – which the US president has billed as “liberation day”.

“They want to make a theatre of it,” one government source was quoted as saying. “They want to have the consistency of saying that they have done everything on the same day. It is a big challenge for us.”

Sir Keir Starmer’s attempts to persuade Mr Trump not to impose tariffs in a phone call on Sunday evening are also reported to have fallen flat – leaving the prospect of an economic deal weeks away.

That is despite UK ministers believing the deal is ready, following concessions which include Britain agreeing to drop plans for a digital service tax on US tech firms, the newspaper reported.

Andy Gregory1 April 2025 09:44

UK firms worst-hit by Trump tariff fears yesterday among biggest FTSE100 gainers in early trading

Our business and money editor Karl Matchett reports:

After yesterday’s market fall in response to the upcoming tariffs – and more relevantly, the wide-ranging uncertainty as to exactly who they are going to affect and how much – today sees London on something of a rebound.

The FTSE 100 is up about 0.6 per cent as a whole after an hour or so of trading, even with a slight drop-off from a quickfire surge at the start of the day.

Individually, more than 80 of the 100 biggest listed firms in the UK are in positive territory for the day so far from a share price perspective, with only five showing a drop of more than 0.5 per cent.

It’s notable that a couple of the biggest gainers are those who took bit hits yesterday: holidays and hotels in Easyjet (up 2.4 per cent), plus Rentokil (up 2.6 per cent), a company with a significant and growing business base Stateside.

Andy Gregory1 April 2025 09:25