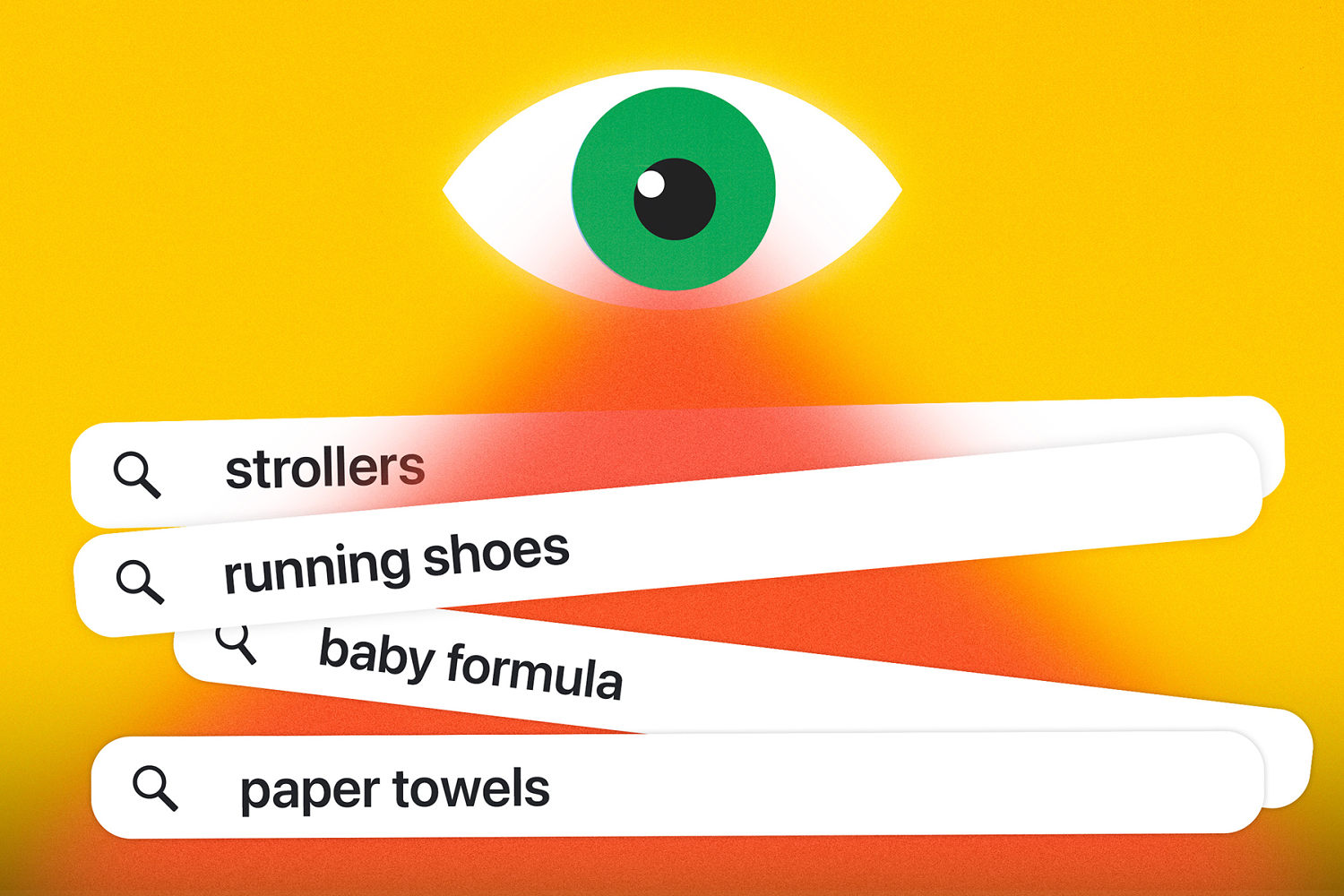

WASHINGTON — From raising the price of diapers for parents who recently searched for them online, to stores excluding regular customers from discounts because they are likely to buy the product anyway, companies are using personal data to set different price points for different people.

The practice, known as “surveillance pricing,” has caught the attention of Rep. Greg Casar, D-Texas, who wants to ban it at the federal level.

Personal data collection has become commonplace in the internet age, with major corporations farming information to tailor marketing and sales pitches specifically to individual consumers. But companies are now using location data, browsing history and demographic background to individualize prices.

Casar believes this practice, which is often done using artificial intelligence, could stack the deck against consumers, leading to higher, uneven prices. The lawmaker, who leads the Congressional Progressive Caucus, told NBC News he wants to ensure that prices are set “based on supply and demand and based on how much it costs to make and sell a thing, not based on spying on you and using your private data.”

The Stop AI Price Gouging and Wage Fixing Act of 2025, which Casar will introduce Wednesday, would prohibit the use of surveillance-based price and wage setting. The bill comes on the heels of a study by the Federal Trade Commission and as some states seek to ban surveillance pricing as well.

Casar said there needs to be more transparency around the use of consumers’ data and artificial intelligence. His bill would also prevent the use of AI to set wages based on personal data, like an individual’s financial history, rather than performance.

“AI is a developing part of our lives, part of our world, but we need to make sure that it’s used for good and not being exploited,” he said. “We’re already starting to see that, and if we don’t intervene now and ban these sorts of price gouging and wage suppression right now, then I think it’s just going to spread all over the economy.”

Casar’s legislation comes after the FTC released the initial findings of its study of surveillance pricing in January. That report, released just before President Joe Biden left office, found that a “person’s precise location or browser history can be frequently used to target individual consumers with different prices for the same goods and services.”

The FTC’s findings are based on information it requested from eight companies that use consumer data when pricing products: Mastercard, Revionics, Bloomreach, JPMorgan Chase, Task Software, PROS, Accenture and McKinsey & Co.

Lina Khan, who chaired the FTC under Biden, oversaw the study. It is unclear what the future of the FTC’s role will be on this issue under the Trump administration, as the agency’s call for public input on surveillance pricing was stopped when new leadership came in.

“One of the most pernicious aspects of surveillance pricing is that people may have absolutely no idea that they’re being targeted by it,” Khan said in an interview with NBC News. “It’s a total black box.”

Khan said the technology is rapidly evolving, making it easier for companies to forecast how much a consumer is able or willing to pay without them knowing. Khan described surveillance pricing as the “holy grail” for companies looking to maximize profits in e-commerce.

“We have quickly slipped into an environment where companies now increasingly have the ability to do this based on just the enormous troves of personal data that are being collected about us, they have the incentive to do it,” Khan said, adding that “unless law enforcers and lawmakers are very clear about these practices being prohibited, companies will think it’s totally fair game.”

Casar noted that Delta Air Lines is one company that is integrating AI into its pricing. On an investor call this month, Delta president Glen Hauenstein said the airline’s goal is to have a fifth of all its fares set by an artificial intelligence program, up from 3% currently. But the company disputed in a statement that prices would be set based on personal information.

“There is no fare product Delta has ever used, is testing, or plans to use that targets customers with individualized offers based on personal information or otherwise,” the company said. “Delta always complies with regulations around pricing and disclosures.”

While Casar’s legislation is the first at the national level, several state legislatures have attempted to take on the issue. For example, the New York Legislature passed and the governor signed legislation to require companies to disclose to consumers when a price is set by an algorithm using their data.

Earlier this month, the National Retail Federation asked a federal court to block the New York law arguing that it would “unfairly malign a system that helps merchants give customers lower prices and personalized offers.”

The California Assembly, meanwhile, passed a bill in May to stop businesses from using personal data when charging different prices for the same product. That legislation now heads to the California Senate.

At the federal level, the House of Representatives is leaving for its August recess this week, so no action can be taken on Casar’s bill until September at the earliest. The congressman said he hopes to “build a broad coalition of members of Congress against this, because I think this is the kind of issue that energizes people all across the country.”

Casar sees a surveillance price ban as an issue that could attract bipartisan support. “I think that’s the kind of thing that pisses off Democratic and Republican and independent voters alike,” he said. “You don’t have to be a progressive Democrat to say these gigantic corporations in the tech world should not be spying on us and then using what they learn to put it into AI and make our life more expensive.”