The global energy landscape is undergoing a profound transformation. Amid ongoing geopolitical tensions, economic volatility, and climate imperatives, NextContinent has identified seven megatrends emerging from the energy sector’s decarbonisation efforts.

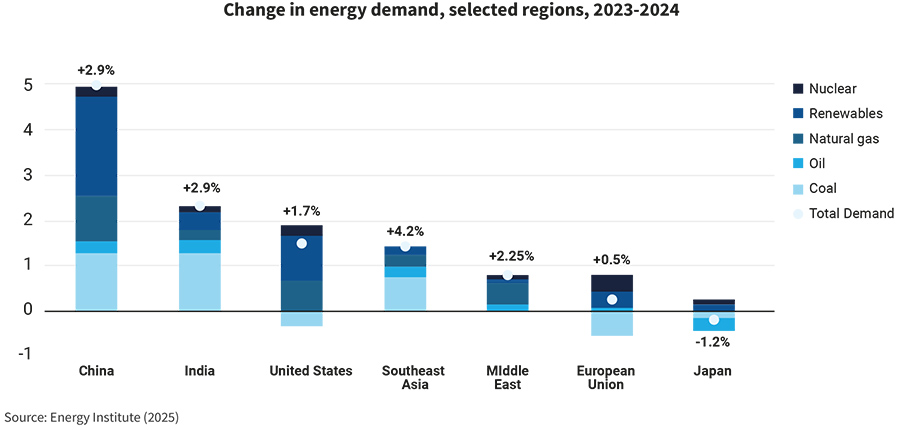

In 2024, global energy demand increased by 2.2%, surpassing the average of the past decade. Renewables accounted for 38% of the growth in global energy supply, followed by natural gas (28%), coal (15%), oil (11%), and nuclear (8%). While there is still some distance to go to meet the sector’s 2050 targets, or avert the worst impacts of climate change, these changes are already having a drastic impact on the world, according to Nextcontinent.

Geopolitical power plays

Throughout the last century, access to fossil fuels has defined many of the world’s geopolitical power struggles. US interference in South American and Middle Eastern states which threatened to nationalise oil supplies was a recurring theme of the decades following the second world war, while more recently, increasingly fraught relationships between Russia and the West have seen gas supplies used as an economic and political weapon. With gas supplies jeopardised west of Ukraine, fears of energy shortages and rampant inflation have had major impacts on Europe and the US.

In the short-term at least, those conflicts persist, due to the slow speed at which Europe and the US have transitioned to renewables. However, as that change picks up pace, it also exposes new geopolitical pressures. As the US in particular ramps up hostilities with China, it is jeopardising the West’s access to crucial facilities – with 85-95% of battery components, 80% of solar panels, and 75–90% of rare earth refining capacity currently in China. At the same time, rare earth and materials have been at the centre of an increasingly tumultuous relationship between Washington and Ukraine – as well as a key motivator behind an unsuccessful coup in Bolivia.

The UK is currently working to try and negate some of these pressures. It has committed to advancing its clean energy industrial policy by establishing strategic partnerships with Canada and Australia to strengthen critical mineral supply chains. Concurrently, it is investing in domestic rare-earth refining capacity, while also prioritising the scale-up of green hydrogen production and the deployment of small modular nuclear reactors (SMR).

Oil and gas majors shift strategies

Even with a moderate rise in the generation of energy from renewable sources, companies depending on fossil fuel consumption for profitability are under mounting profit pressure. At the same time, with Saudi Arabia ramping up oil production – partially as a geopolitical manoeuvre of its own – oil prices have fallen dramatically, further impacting the sector’s biggest entities. But rather than pivoting their business models to make the most of renewable opportunities, many are moving in the opposite direction.

Nextcontinent pointed to TotalEnergies as one example among many. Having already recorded a decline in net profit in 2024, the drop in oil prices in 2025 is reinforcing “the need for strategic shifts” – which has seen the company cut its low-carbon investment plans by $500 million, “signalling a reassessment of its energy transition ambitions in light of tighter margins”. Similar short-termism has seen BP roll back its target to reduce oil and gas production by 40% by 2030, lowering it to 25%.

With even the wealthiest, most carbon intensive companies being unwilling to commit to net zero goals if they can’t maintain higher levels of profitability, this has raised questions about whether it is realistic to leave the energy transition to the private sector. Some organisations are weighing up consolidation, rather than cut-backs, to move ahead, however. Notably, Shell is reportedly exploring the merits of acquiring BP, in what would be a landmark consolidation to form a European energy powerhouse capable of competing with ExxonMobil. While this potential merger is still in the evaluation stage and Shell is not the only potential buyer, it illustrates the potential for strategic repositioning among oil majors.

Global energy mix including nuclear

With clean energy sources expanding and fossil fuel growth slowing, the need to effectively manage the mix of energy is growing. Up to 20% of current levels of oil and gas will still be needed as part of that mix until 2050, according to the previous estimations of experts from AnTech.

According to Nextcontinent, this shift is particularly evident in regions such as Europe and the United States, and reflects broader structural, policy, and market changes. In the UK, a growing part of that energy mix is from the nuclear segment.

Among the European countries, UK in particular has emerged as a global leader in offshore wind, having added over 4 GW of new capacity in 2024. Solar deployment and heat pump adoption are rising steadily, supported by the Warm Homes initiative announced in mid-2025. But the country has also re-affirmed its long-term commitment to nuclear with continued investment in the Sizewell C project6 and early-stage SMR development.

Clean energy investments are rising sharply

The global drive towards net-zero emissions has catalysed record levels of investments in clean energy technologies. In 2024, total energy investment worldwide was poised to exceed $3 trillion, with approximately $2 trillion directed towards clean technologies, including renewables, electric vehicles, nuclear power, grids, storage, low-emissions fuels, efficiency improvements, and heat pumps.

Leading that charge, solar investments exceeded $500 billion, remaining the single largest source of power generation investment. Meanwhile new capacity additions in the nuclear sector rose by 33% compared to 2023; and nuclear construction starts increased by 50%, driven primarily by China and Russia. But regional discrepancies persist – and may impact on this trend in the future.

While China and the European Union continue to scale up public and private financing in clean energy, the change in administration in the US has once again seen a sharp reversal in federal climate and energy policy. Following the US withdrawal from the Paris Agreement in March 2025 under the second Trump White House, multiple federal programs supporting carbon capture (CCUS), decarbonisation, and green finance have been cancelled or suspended – while capitulation from the opposition suggests that whoever forms the next administration may not simply reverse these moves as was the case with the Biden presidency.

Digitalisation and technological innovation

The rapid advancement of digitalisation and technological innovation is “fundamentally reshaping the energy sector”, according to Nextcontinent. This is “revolutionising the ways in which we manage, distribute, and utilise energy resources to create more efficient, sustainable, and secure systems”. And of course, AI is one of the pivotal pieces of technology being referred to. But after years of hype, the experts believe working examples are finally appearing of what AI’s ‘potential’ actually yields.

Key applications include smart grids, which help balance electricity supply and demand more efficiently. AI is also playing a growing role in the energy sector. It is used in areas such as biofuel discovery, electric vehicle (EV) charging optimisation, and clean energy research. Companies like Shell are already applying these technologies. These advancements, the researchers say, “lead to better forecasting, improved reliability, and enhanced sustainability in energy distribution.”

Pointing to the impacts, the study notes, “While enhanced productivity and reduced operational costs are important early outcomes, the true value of these technologies lies in how they enable a broader transformation. They play a critical role in advancing sustainable energy models, helping to build systems that are not only more efficient but also more environmentally responsible. Moreover, the integration of smart technologies improves the security and reliability of energy systems, addressing some of the critical challenges in the sector.”

Data centres drive demand

Contrary to that, while AI is finding some places to make efficient and environmentally responsible systems, the technology currently requires huge data centres to function – which hoover up energy at unprecedented rates. With data centres emerging as significant consumers of electricity, there is a threat that digital technology could give to the green energy transition with one hand, while taking with the other.

Power demands from data centres had plateaued from 2010–2020. But as cloud computing, streaming services, gaming, and large-scale AI models continue to expand, electricity consumption by data centres, already estimated at 240–340 TWh (about 1–1.3% of global power use) in 2022, is now growing rapidly. Investment in AI start ups, some $225 billion over the past five years, and capital spending of around $150 billion by major tech firms in 2023 underscore the scale of this surge. These trends necessitate innovative solutions and sustainable practices to manage rising demand and maintain grid reliability.

The researchers added, “Driven by technological advancements, regional demand growth, and policy shifts, the surging electricity demand from data centres is reshaping the energy landscape. This trend underscores the critical need for sustainable practices, robust supply-chain strategies, and innovative regulatory frameworks to ensure a balanced and efficient energy future.”

The sector faces a growing skills gap

Over the past decade, excitement around new digital technologies has constantly gone hand in hand with fears of a ‘skills gap’ – with companies concerned that they would invest in expensive new technologies, only to find they have no access to labour that can get the best from the changes. But on top of the technological aspect, there was already a high demand for skilled workers in renewables, nuclear power, and digital grid management. This trend highlights workforce challenges, rising job demand, and the industry’s efforts to address them.

To address these workforce challenges, the energy sector is investing in academic partnerships and specialised training programs. In the UK, Nextcontinent points to examples including the Green Jobs Taskforce and STEM re-skilling grants, which have become part of national strategies to address the perceived shortage of skilled energy workers.

The experts concluded, “The energy landscape in 2025 presents a paradox of opportunity and uncertainty. As clean energy investment accelerates and digital innovation reshapes the industry, vulnerabilities, ranging from supply chain dependencies to global instability, remain acute. Navigating this environment requires strategic foresight, operational agility, and sustained commitment to transformation. The decade ahead will test the sector’s ability to evolve at speed and scale. Energy players that act now, by investing, diversifying, and building resilience, will be best positioned not only to adapt, but to lead.”