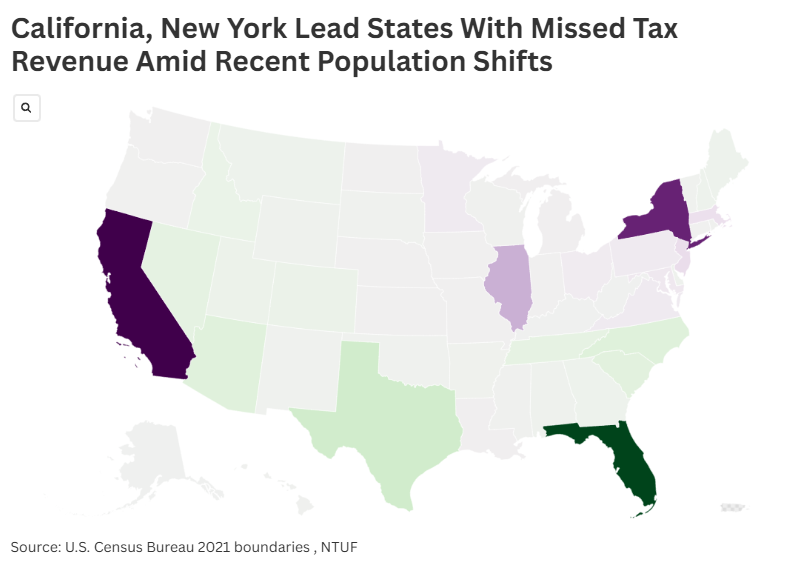

Americans moving out of places like California and New York are costing those states billions of dollars in taxpayer funds, according to data analysis released by the National Taxpayers Union Foundation (NTUF) this week.

Why It Matters

States bleeding population face myriad challenges, including the loss of taxpayer funds that could be used to pay for critical services for residents. It also has political ramifications, including the loss of seats in the House of Representatives. The next round of redistricting could have major implications for political representation, with larger red states poised to gain House seats. Major Democratic states, meanwhile, are on track to lose seats if migration patterns do not shift.

The report noted that population shifts are largely among high-income residents, underscoring the loss of taxpayer funds to other residents in those states.

Ringo Chiu via AP

What To Know

The new data analysis from the NTUF, a conservative-leaning economic organization, revealed estimates for how each state’s population shifts are affecting tax revenue in 2025.

Florida gained the most new residents to internal migration, with more than 1.5 million Americans moving into the state from 2011 to 2021, which is resulting in $4.1 billion in additional revenue in 2025. Texas followed, gaining more than 1.2 million new residents and an additional $914 million in additional revenue, according to the data analysis.

North Carolina, Arizona and South Carolina were among the other states that have seen the highest increase in tax revenue as a result of attracting new residents from other states.

On the other end of the spectrum was California, which lost 1.6 million residents from 2011 to 2021, resulting in a $4.5 billion revenue loss. New York followed, seeing a $3.8 billion revenue lost in 2025 after losing 1.7 million residents during that time frame, according to the report.

Illinois, New Jersey and Massachusetts were other states that have lost at least $500 million in tax revenue as a result of losing residents.

Estimated revenue changes are “driven primarily by the movement of high-income earners, who tend to pay far more in taxes than they receive back in government service,” according to the report.

What People Are Saying

Andrew Wilford, director of NTUF’s Interstate Commerce Initiative and author of the report, in a press release: “While tax rates are not the only reason taxpayers move to different states, it is hard to deny that they play a substantial role in where taxpayers decide to live. When looking at broader trends, the clear pattern is that taxpayers move from states with higher tax burdens towards states with lower ones. Tax rates explain this trend better than any other explanation put forward, from weather to the cost of housing.”

William Frey, a demographer and senior fellow at the Brookings Institution, told Newsweek in December: “When it comes to deciding when to move, it’s sort of like the last election. It’s a pocketbook thing. When it’s too expensive to live somewhere, you’re going to look where there are job opportunities.”

What Happens Next

Whether these trends hold over the coming years will impact redistricting and state budgeting. If it holds, the impact could be felt in next decade’s presidential elections.