FTSE 100 hits 9,000 points for the first time ever

Newsflash: Britain’s blue-chip stock index has risen through the 9,000 point mark to hit a new record high.

The FTSE 100 share index hit 9016.98 points at the start of trading in London, up around 0.2% today, taking its gains during 2025 to over 10%.

That’s a new intraday high for the “Footsie” (as it is known in City circles).

As covered in the introduction, the London stock market has benefitted from a range of factors this year, including a move by some investors to diversify away from the US stock market due to concerns over Donald Trump’s economic policies.

The Trump trade war has also helped UK stocks, as Britain is one of the few countries to have reached a trade deal guaranteeing lower tariffs.

Key events

Bank of England eases rules for challenger banks

Kalyeena Makortoff

The Bank of England is easing rules for challenger banks, in a move meant to give a leg-up to mid-size lenders like Metro Bank and Starling.

One of the biggest changes involves changing rules around so-called MREL – or “Minimum Requirement for own funds and Eligible Liabilities”- which is one of the financial safety nets introduced in the wake of the financial crisis and came into force in 2016.

The Bank is raising the threshold at which smaller banks have to hold emergency funding that would ensure they can wind down without taxpayer support if they fail.

It means that, going forward, banks will only become subject to that emergency funding once their assets total £25bn-£40bn, compared to current thresholds which start from £15bn-£25bn. (It’s within that range that the BoE decides how to apply the MREL requirements, and which would be most appropriate for the bank in question)

MREL, which is made up of a mix of loss-absorbing debt and equity, will now be reviewed and thresholds updated, every three years starting in 2028, to reflect wider economic growth.

The Bank’s Prudential Regulation Authority has also announced “prospective plans” that would “make it easier for mid-sized banks to compete in the mortgage market.

There are few details so far, but the PRA said it will publish a discussion paper this summer that would give mid-sized lenders the ability to “adjust some barriers” to gaining permission from regulators to build their models that measure the risk of residential mortgages on their books (known as Internal Ratings Based Models).

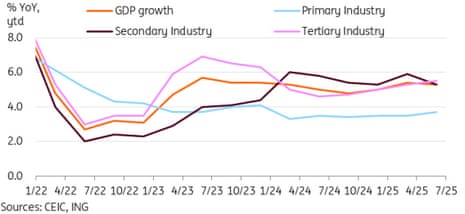

China’s GDP growth slows, but beats forecasts

The financila markets have also been cheered by the news today that China’s economy grew faster than expected in the second quarter of this year.

The world’s second-largest economy grew by 5.2% in the April-June quarter compared with a year earlier, beating forecasts of a 5.1% rise.

That’s still a slowdown from the 5.4% annual growth recorded in the first quarter, but means Beijing is still on track to hit its GDP target for 2025 of “around 5%”.

Activity appears to have been lifted by a rush to beat new US tariffs on Chinese goods.

“China achieved growth above the official target of 5% in Q2 partly because of front loading of exports,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management, who added:

“The above target growth in Q1 and Q2 gives the government room to tolerate some slowdown in the second half of the year.”

A 6.8% rise in industrial production in June also boosted China’s GDP in Q2.

Lynn Song, chief economist for Greater China at ING, explains:

The biggest beat in June monthly data was in the value added of industry, which surprisingly bounced back to a three-month high of 6.8% YoY, up from 5.8% in May, bucking expectations for a further slowdown.

June industrial production benefited from a pickup of manufacturing (7.4%), in particular hi-tech manufacturing (9.7%), which has been an outperformer amid China’s transition up the value-added ladder.

RBC Brewin Dolphin: why the FTSE 100 has reached 9,000 points

John Moore, wealth manager at RBC Brewin Dolphin, says there are several reasons behind the FTSE 100’s ascent to 9,000 points today.

“The FTSE 100 has been driven to the 9,000-point milestone by several factors. Firstly, while the index’s composition had been a brake on its progress compared to other markets, now it is providing a tailwind, with strong earnings momentum in the banking and defence sectors, in particular, supported by the likes of some of the larger operators in other industries such as Next, Tesco, and National Grid.

“Currency has also played a role, though its impact is likely to fluctuate over time. If UK earnings grow by, say, 7-8%, but the pound moves 2-4% relative to the dollar, then you can meet or exceed what you might reasonably expect from the US market with the added benefit of sectoral and stylistic diversification in your investments.

“At the same time, the UK still offers robust income and optionality. That may have been out of favour in recent years, but the cash flow can be helpful in terms of managing a portfolio and providing a form of income beyond cash yields and bonds. And, while resource companies – which often produce a reasonable level of income – haven’t been working out recently, that could turn and provide some cyclical upside along with some indirect exposure to China.

“A number of UK companies have been taking self-help measures, with lots refining their portfolios and buying back shares. Oxford Instruments is a prime example, selling a non-core asset at a good price and then undertaking a £50 million share buyback programme. The likes of Hiscox and DCC have done similarly, and it is becoming more universal.

“Finally, the UK offers relative political stability compared to other parts of the world at present. While there may be tax increases to come, which was part of the reason for the sell-off of the pound in early June, the government has a clear mandate and tenure for the next few years. That compares favourably to other parts of Europe, even, where coalition governments are having a tough time.”

The FTSE 100 has also benefitted from the TACO trade this year – the bet that Trump always chickens out when his policies cause mayhem in the markets.

As this chart shows, shares in London slumped in early April after the US president announced high new tariffs on US trading partners.

On 7 April it hit a low of 7544 points, amid fears that Trump’s tariffs would chill global trade. But it then began to rally after the US president delayed those tariffs for three months, until early July (the deadline has since slipped again to 1 April).

UK defence companies have had a strong year on the stock market, helping to push the FTSE 100 to a record high this morning.

Defence contractor Babcock’s shares have risen by almost 120% this year, with BAE Systems up 65%, as Nato members have agreed to increase defence spending.

Engineering firm Rolls-Royce has gained 75%, as its turnaround plan has yielded results.

FTSE 100 hits 9,000 points for the first time ever

Newsflash: Britain’s blue-chip stock index has risen through the 9,000 point mark to hit a new record high.

The FTSE 100 share index hit 9016.98 points at the start of trading in London, up around 0.2% today, taking its gains during 2025 to over 10%.

That’s a new intraday high for the “Footsie” (as it is known in City circles).

As covered in the introduction, the London stock market has benefitted from a range of factors this year, including a move by some investors to diversify away from the US stock market due to concerns over Donald Trump’s economic policies.

The Trump trade war has also helped UK stocks, as Britain is one of the few countries to have reached a trade deal guaranteeing lower tariffs.

Thames has reported a rise in pollution incidents in the last year – they rose to 470 from 350 pollutions in the previous 12 months.

The company admits that reducing pollutions “continues to be a significant challenge for us”, and blames wet weather, saying:

Groundwater levels remained high and rainfall was above average, albeit not at the severity we saw in the previous year. Prolonged wet weather meant further rain had nowhere to go other than to inundate our ageing and fragile sewer network.

Reducing pollutions and discharges is something we’re really focused on, and we plan to invest record amounts in our waste network during the next five years.

CEO Chris Weston was paid just over £1m for running Thames last year, despite missing out on a bonus.

Today’s annual report shows Weston received total pay of £1.035m, including a salary of £850,000 plus pension benefits of £102,000. He did not receive any ‘variable’ pay, though.

The directors’ remuneration report explains:

As a result of pollution incidents performance, as well as the credit downgrading in 2024/25, which resulted in the Company no longer holding two investment grade ratings, the payment of a performance-related pay award to Chris Weston, for the 2024/25 financial year has been prohibited.

In June, the government announced that bonuses for 10 water company executives in England would be banned with immediate effect over serious sewage pollution.

Thames Water made a loss last year despite a rise in revenues, as customers were hit by higher bills.

The company has reported a £201m increase in underlying revenues, to £2.603bn.

Thames explains:

This increase was driven primarily by rises in our charges for water and wastewater services, per our allowed regulated revenue. Our 2024/25 allowed revenue reflects a Consumer Prices Index including Owner Occupiers’ Housing costs (CPIH) inflation rate of 4.2%, regulator-approved “K” factors of -4.9% for water and +4.1% for wastewater.

These increases were partially offset by historic wholesale and retail Outcome Delivery Incentive (ODI) penalties, which have a two-year lag flowing through into revenue

Thames Water CEO: turnaround will take at least a decade

Thames Water’s CEO has admitted it will take “at least a decade” to turn the company around.

Announcing today’s annual report, Chris Weston insists that Thames “made good progress in operational performance” in 2024-25, despite “the ongoing challenging financial situation”.

Weston adds:

“We invested a record £8.5 billion in infrastructure between 2020 and 2025. We enter the new regulatory period of 2025-2030 in a better place than we entered the 2020-25 period with leakage at its lowest ever level, down by 13.2% since 2020. A defining moment last year was the connection of the £4.5 billion Thames Tideway Tunnel to our London network supporting the reduction in sewage entering the tidal River Thames by 95%.

We recognise that our current gearing is too high and, to address this, we are progressing with our Senior Creditors’ plan to recapitalise the business which will see us return to a more stable financial foundation. This will come with a requirement to re-set the regulatory landscape and acknowledge it will take at least a decade to turn Thames around.”

Here’s a chart from Thames’s annual report, showing its financial performance in the year to 31 March 2025.

Thames Water reports £1.6bn loss

Newsflash: Troubled utility company Thames Water has reported a loss of over £1.6bn for last year, hours before its top executives are due to be grilled by MPs.

Thames’s annual report, just released, shows it made a total loss before tax of £1.647bn in the 2024/25 financial year, down from a £157m profit before tax in 2023/24.

Thames blames this whacking loss on a range of ‘exceptional expenditure’, including fines imposed by the regulator and costs associated with its restructuring plan as the company tried to avoid collapse.

Its annual report cites:

-

£1,271 million of expected credit loss provision recognised against the intercompany loan receivable from TWUL’s immediate parent company, Thames Water Utilities Holdings Limited. This balance is fully provided for, as it is not deemed recoverable

-

£285 million of exceptional financing costs, including consent fees related to our restructuring plan

-

£122 million of provisions raised for fines as a result of Ofwat investigations

-

£65 million of fees for advisors supporting in the equity raise process and balance sheet restructuring process

-

£33 million of turnaround and transformation expenditure

Even without all those costs, Thames made an underlying loss before tax of £6m, down from a profit of £204m in 2023/24.

Thames’s chairman, Sir Adrian Montague, says progress has been made towards putting Thames Water on a more stable platform.

We remain of the view that a market-led solution is in the best interests of our customers, UK taxpayers and the environment, and it is testament to our people that we’re moving forward with our recapitalisation and operational turnaround. It hasn’t been an easy path to get here, and we still face significant challenges, but we’re moving in the right direction.

Despite the huge scrutiny we are under, our teams have remained focused on the business priorities and the delivery of our essential services.

Montague will be quizzed by parliament’s EFRA Committee today, along with CEO Chris Weston and non-executive director Ian Pearson.

Introduction: FTSE 100 could hit 9,000 points today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain’s stock market could enter uncharted territory today.

After touching a record high of 8,999 points last night, the FTSE 100 is on track to rise over the 9,000-point mark for the first time today.

2025 has already been a strong year for the Footsie, which has gained 10% since the start of this year.

Stocks in London have benefited from some investors looking to diversify their holdings beyond the US market, due to concerns over Donald Trump’s policymaking.

Growing confidence that Trump will back down and agree trade deals (the TACO trade) has also helped markets since the president’s tariff u-turn in April.

The FTSE 100 has also benefited from the recent weakness of the pound, which pushes up the value of multinational companies with overseas earnings. More nervous traders will have found its defensive stocks attractive.

The UK’s trade deal with the US has also bolstered confidence in British companies, at a time when Europe is being threatened with a 30% tariff from April.

AJ Bell investment analyst Dan Coatsworth says the UK has come out triumphant, explaining:

Not only has it got the framework of a (limited) trade deal in the bag, but its stock market has shown muscle in the wake of the EU worries. Its plethora of defensive industries have won over investors once again, with utilities, healthcare and grocers among the top risers on the FTSE 100.

“The UK stock market is the calming cup of tea and biscuit in an uncertain world. There’s nothing fancy on offer, just reliable names that do their job day in, day out. That’s an underrated characteristic and a reason why investors are finally warming to the UK stock market’s appeal in 2025.”

The futures market indicates the FTSE 100 will open higher, over that 9,000-point mark.

Against the European trend, FTSE 100 bounced yesterday on rate cut optimism, led also by a rally by some mining stocks. Wall Street trod water, thanks to Trump’s irrational tariff war – Opening calls FTSE circa +13 points at 9011, DJIA circa -23 points at 44436 at 5.36am

— David Buik (@truemagic68) July 15, 2025

The agenda

-

9.30am BST: Chancellor Rachel Reeves to announce ‘Leeds’ reforms of financial services

-

10am BST: The EFRA Committee will question Thames Water’s Sir Adrian Montague, Chris Weston, and Ian Pearson

-

10am BST: ZEW index of eurozone economic sentiment

-

10.15am BST: Officials from the Office for Budget Responsibility appear before the Treasury Committee

-

1.30pm BST: US inflation report for June

-

2:30pm BST: The Business and Trade Committee hold hearing with regulators, including FCA and Ofwat

-

Tonight: Mansion House speeches